Understanding 1031 Exchanges: A Powerful Tool for Real Estate Investors

If you’re selling investment property, you’ve likely heard the term 1031 Exchange. This IRS program is one of the most effective strategies for deferring capital gains taxes and building long-term wealth through real estate. But what exactly is a 1031 Exchange, and how does it work? Let’s break it down.

What Is a 1031 Exchange?

A 1031 Exchange (named after Section 1031 of the IRS tax code) allows you to sell one investment or business property and reinvest the proceeds into another “like-kind” property — all while deferring capital gains taxes. Instead of paying 20–30% in state and federal taxes immediately, investors can roll their equity into another property and keep their money working for them.

This strategy applies to a wide range of property types, including:

-

Residential rentals

-

Multi-family properties

-

Office or medical buildings

-

Retail and hospitality

-

Agricultural or vacant land

-

Industrial or mixed-use assets

Why Do Investors Use 1031 Exchanges?

The benefits go beyond just saving on taxes. Common reasons include:

-

Tax deferral: Avoid immediate capital gains and depreciation recapture taxes.

-

Portfolio growth: Trade up into larger or more profitable properties.

-

Diversification: Exchange into different property types or locations.

-

Estate planning: Transfer real estate into multiple properties to split between heirs.

-

Preserve equity: Keep more money invested rather than paying a large tax bill.

Key Rules and Deadlines

The IRS has strict requirements for 1031 Exchanges, and missing a deadline can invalidate the tax deferral:

-

Use a Qualified Intermediary (QI): A neutral third party must handle the exchange. You can’t touch the funds yourself.

-

45-Day Identification Period: After selling your property, you have 45 days to identify replacement properties in writing.

-

180-Day Closing Window: You must close on the new property within 180 days of selling the old one.

-

Same Taxpayer Rule: The name on the sold property must match the name on the purchased property. Exceptions apply for trusts, but not for partnerships.

-

Reinvestment Requirement: To fully defer taxes, you must reinvest the entire net sales price — not just the profit — and replace any debt paid off with new debt or additional cash.

Common Questions About 1031 Exchanges

Can I sell a rental house and buy a fourplex?

Yes. Almost any investment or business real estate qualifies as “like-kind.” You can move between different property types, such as selling land and buying apartments.

Can I move into the property I buy?

Not immediately. The IRS requires the property to be purchased with investment intent. After a safe-harbor period, some owners may convert it to personal use, but always check with a tax advisor.

Can I rent to my child or family member?

Yes — but only if they pay fair market rent, just like any other tenant.

What happens if I don’t use all the money?

Any leftover funds (called “boot”) are taxable. Some investors explore more advanced options like improvement exchanges if they want to use funds for renovations.

How much does a 1031 Exchange cost?

Typically between $750 and $1,500 depending on the complexity.

Final Thoughts

A 1031 Exchange is one of the most valuable tools available to real estate investors. It not only defers taxes but also helps build wealth, diversify holdings, and plan for the future. However, these exchanges are complex and must be done correctly to qualify.

Before moving forward, always consult with your tax advisor and work with a qualified intermediary to ensure compliance with IRS rules.

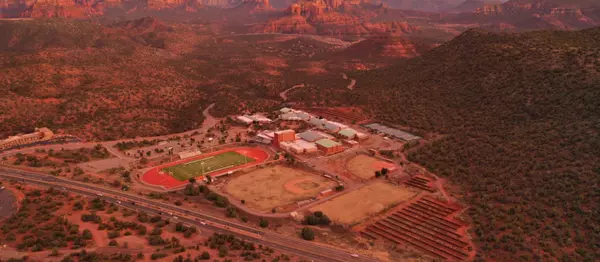

If you’re curious about whether a 1031 Exchange could help you maximize your real estate investment strategy here in Sedona and the Verde Valley, I’d love to walk you through the options and connect you with trusted tax professionals.

Categories

Recent Posts